-40%

NEW 100% Return Home Study Options Credit Debit Spread Trading Course System DVD

$ 21.11

- Description

- Size Guide

Description

Only Paypal Payment Accepted.4 DVD

Home Options Trading Strategies Course + Workbooks

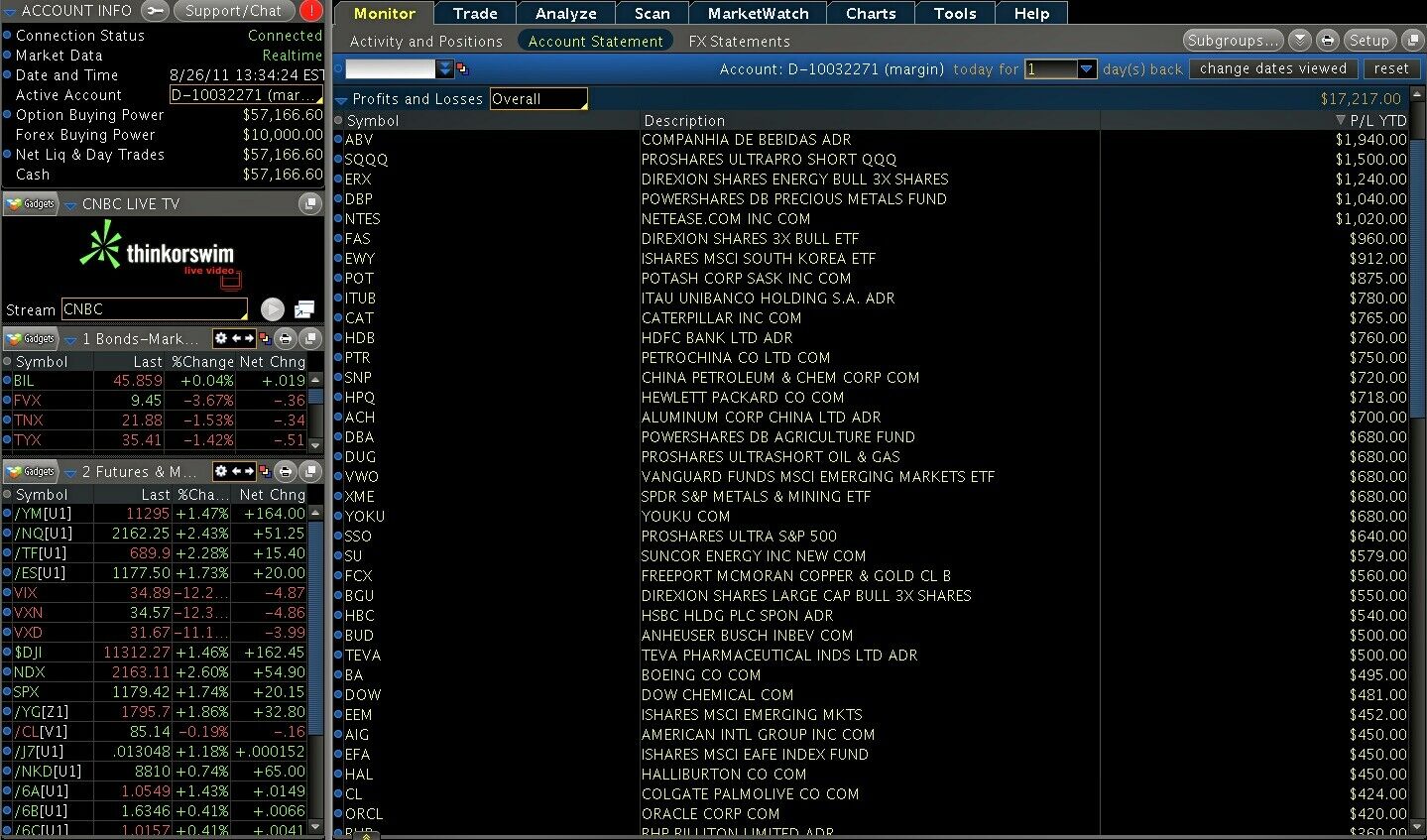

0,000 live Account Statement show here

Original Curriculum

55 hours of solid retail-based self-directed trading techniques.

There is approximately 12.75GB of digital items to download, consisting of 24 files:

1 Excel File, 6 PDF Files & 17 Quicktime Training Videos. Curriculum is priced in USD.

Check that you have a Total of 24 files:

6 PDF files: 0 Start Here.pdf, 1 Asset Allocation.pdf, 2 Point&Figure.pdf, 3 IV&Skew.pdf, 5 Portfolio.pdf and 6 Market Ranges.pdf. Lesson 4 uses the “Greeks Revisited” tab inside H–O–T Business.xls and does not have a PDF file. The PDF numbering of files skips 4, so there is only 0, 1, 2, 3, 5 and 6.

1 Excel spreadsheet: H–O–T Business.xls.

17 QuickTime videos.

0 Start Here.pdf

1 Asset Allocation.pdf

2 Point & Figure.pdf

3 IV & Skew.pdf

5 Portfolio.pdf

6 Market Ranges.pdf

H-O-T Business.xls

1 Asset Allocation.mov

2 Point & Figure.mov

3-1 IV & Skew.mov

3-2 IV & Skew.mov

4 Greeks Revisited.mov

5 Portfolio.mov

6 Market Ranges.mov

S1 Calendar.mov

S2 Credit Iron Condor.mov

S3 Credit Vertical Call.mov

S4 Credit Vertical Put.mov

S5 Debit Iron Condor.mov

S6 Straddle.mov

S7 Debit Vertical Call.mov

S8 Debit Vertical Put.mov

S9 Back Ratio Call.mov

S10 Back Ratio Put.mov

WHAT IS THE VALUE OF USING THE METHODS TAUGHT?

Possible consistent results with these options trading strategies include but are not limited to:

❑

Credit Spreads: 2%-4% returns per day per trade, exited within 30 days, chosen for entry between 30–50 days.

❑

Debit Spreads: 150%-200+% returns per trade, exited within 30-60 days, chosen for entry between 90-120 days.

❑

Above 70% Win/Loss Probability with a Positive Expectancy per trade, as a Diversified Multi-Asset Class System.

What's in the Original Curriculum (55 Hour video course)? These are the Topic's Objectives and Issues to Solve ...

1. Asset Allocation & Diversification

❑

Diversification is re-defined to fit retail traders with smaller sized accounts (typically USD K-K and below), recognizing it is private capital at risk without access to bank loans to fund personal trading from home.

- Specific techniques to remove single-stock exposure and eliminate the risk of trading multiple spread types but still concentrated in Equities; effectively, rebalancing the portfolio and reducing concentration risk in any one particular Asset Class.

- Surfacing the Inter-Market Risks already embedded within a stock, to trade and control these risks directly, instead of not being aware that these risks are already contained within the stock.

- Removing duplication of the same stock as components listed in Equity-based Index products, by diversifying into other Asset Classes where Equities is not a direct component of the Index.

❑

Why conventional Technical Analysis and Fundamental Analysis fails to systematically weigh the relative strength of outperformance against the relative weakness of underperformance, as volatility alternates between multiple asset classes.

- Instead the unique Price measure of Relative Strength, not the TA Indicator “RSI”; but, a robust and adaptive metric based on straightforward numerator-denominator mathematics replaces Fundamental Analysis.

❑

How to synchronize limited retail-based capital with institutional shifts between strong(er)/weak(er) asset classes of Equities, Bonds, Commodities and Currencies using the relevant Indexes and ETFs.

2. Point & Figure Charting

❑

Why time-based charts (Candlestick, Heikin Ashi, OHLC, etc.) visually confuse the observation of Pure Price, as reconciling different time units (Minute/Day/Week) distorts and dilutes how much Price actually moves; or, does not move. Price is a continuous variable but time is a discrete variable and placing the two on the same graph fails to depict the Purity of Price’s measured move or non-movement.

❑

Why patterns in Candlestick, Heikin Ashi, OHLC charts lose their characteristics once mapped onto a distribution curve using frequency and price.

❑

Use of Point & Figure charting’s percentage scaling method as the valid scaling method to treat price as a continuous variable for which all price points are valid on a logarithmic scale. Price points treated this way then become valid to map onto a distribution curve.

❑

Remove misleading effects of time on price by tuning out time’s noise amplification, especially under Overbought/Oversold conditions. Removal of fake outs and gaps altogether.

❑

Identify obvious Support/Resistance levels affecting pricing of Calls and Puts, making Trend Line recognition and Range Setting indisputable.

❑

Calculate Price Targets purely on price alone for a clean computation of Reward to Risk Ratios.

❑

Price Reversals recorded by Point & Figure’s unique construction means volume activity is already embedded in the reversal counts without having to graph volume separately. Removes the confusion of having to reconcile price with volume-based and other TA studies, simplifying the set up of P&F charts.

A valuable course designed to recover the cost in 1 to 2 trades.

3. Implied Volatility and Skew Forecasting

❑

Why reconciling Historical Volatility against Implied Volatility and looking for a HV-IV cross-over fails to be a consistent trading technique.

- Historical Volatility calculated as Statistical Volatility using past price movements of the underlying asset with a finite but adjustable number of days is computationally different from Implied Volatility, which is comprised of expected bid-ask estimates that are refined within fixed intervals of expiration cycles and must converge at zero on specific expiration dates.

❑

Problem of re-simulating unique macro-economic parameters affecting the Historical Volatility in Asset Classes. As such, Historical Volatility is removed altogether from the trading process, focusing purely on Implied Volatility alone.

❑

IV of options (ITM/ATM/OTM) must converge at zero on expiration date; but, price can go anywhere on expiration date (up/down/drifting) … what are the implications?

- Trading Implied Volatility effectively boils down to buying time decay at a % point below; or, selling premiums at a % point above the theoretical price of market value that participants are willing to pay/sell for.

❑

Isolate the traits of a strike’s Moneyness (ATM/OTM/ITM) in constructing different spread types to fit the size of your trading account.

❑

Why a spread’s construction must forecast Implied Volatility specific to Calls (e.g. Vertical Call), separate of Puts (e.g. Vertical Put) and combined as Calls+Puts (e.g. Iron Condor & Calendar).

- Using iVolatiltiy’s Hi/Low indicator to forecast +10% rise in IV for Debit spreads and –10% rise in IV for Credit spreads. Plus, analytics for IV Mean Reversion and IV Mean Repulsion.

- Assessing the mid-range risk zone of Implied Volatility remaining flat within 60-120 days that is not useful for Debit spreads and flat-lining within 30-60days that is not useful for Credit spreads.

- Role of the Relative Volatility Index (RVI) study (absent of price, using only Standard Deviation) to filter the Implied Volatility forecast.

❑

Treatment of IV as synthetic Time and vice–versa.

- Translating the mechanics of the maths of Theta, Vega and Gamma as expressed in the Black-Scholes model, to simulate and control the associated risks for a specific spread type in the trading platform.

❑

Time gapping Theta: subsidizing the payment of decay in debit spreads by receiving premium from credit spreads within the appropriate time periods.

❑

Criteria for Probability of Touching strikes to enter/exit, automating the monitoring of Implied Volatility alerts and Theta-based break even dates versus price-based break even points.

❑

Rejecting the misuse of the Skew as a flawed signal to over/under price options. Instead, Skew (Zero, Negative and Positive) will be defined specifically in terms of the frequency of the probability of price distribution.

- Treating skew this way sets up a sensible framework to understand the changes in pricing with the Supply of Puts versus Demand for Calls and the changes in pricing of Puts/Calls, as the underlying’s price tests/re-tests Support and Resistance levels.

4. Greeks Revisited

❑

Beyond the definition of Delta, Gamma, Theta and Vega, revisiting these Greeks states clearly how to get more or less sensitivity to a specific Greek by choosing the moneyness of the strikes (OTM, ATM and ITM).

- Respond to the changing relationships between Greeks as the product’s price trades towards OTM, ATM or ITM.

❑

Assess the impact on Greeks with Stock Splits.

❑

Beta Coefficient, Beta-weighting Deltas and the difference between Beta versus Correlation.

❑

Relationship between Exercise and Assignment, as you toggle between the roles of an options buyer with debit spreads versus an options seller with credit spreads.

- How to assess the economic viability of exercising early or not.

- Differences in obligation for the option seller between an American-styled product (stock-settled) versus an European-styled product (cash-settled).

❑

Categorization of Greeks for Defined Risk spreads with both Limited and “Un”limited Reward

- Delta, Gamma, Theta and Vega defined for 15 Credit Spreads, 20 Debit Spreads; directionally these spreads translate into 12 Bullish Spreads, 9 Bearish Spreads and 20 Directionally Indifferent/~Neutral Spreads.

5. Portfolio Diagnostics

Establishing Performance Parameters for the Portfolio

❑

Maximum Return Target is the complete achievement of the “ideal” measure, to stretch your reach beyond the immediate grasp. E.g. 3 x current monthly salary.

- Forces persistent evaluation of every part of your trading process to identify improvement.

- Evaluate reality of substituting wages/salary/other regular income with trading profits.

❑

Minimum Return Target is the lowest acceptable measure, achievable under most market conditions.

- Understand why you must re-engineer the processes within your entire trading system, if your portfolio’s returns are between the bottom boundary benchmark of the S&P500’s Average Annual Returns (10% to ~12% p.a, pre-crisis) and the 3-Month T-Bill.

❑

“Halt Trade” Target is when cumulative losses reach a threshold below the Minimum Return Target.

- Recognizing the Point of pain that marks failure in grasping the base-line of acceptable returns.

- Logic for setting the threshold at ~10% of [60% x original cash balance or Net Liquidating Value].

❑

Drawdown is when any loss lowers the account’s highest profit for a given term

- Evaluate the relationships between Drawdown, Average Holding Period and Average Trade Turnover, to assess the average number of days it takes you to turn a profit, to add the profit to reduce the losses as a means of recovery to get to a new high.

Insights into your tendencies to identify required behavioural changes for clarity in improving trading results

❑

Accuracy as measured by the Win / Loss Probability.

❑

Responsiveness as measured by the Average Win / Average Loss.

❑

Combining Accuracy plus Responsiveness as a sustainable Performance Ratio to moderate % of capital allocated.

❑

Implication of linearity of individual position sizing and sensitivity to Greeks for capital allocation per trade.

Expected Return calculations

❑

Positive / Negative Expectancy and what it means for the processes within your trading system.

❑

How many cents in each at risk, can you expect to win?

❑

How to work out your yearly expected return.

❑

Measuring your efficiency of Cash Utilization

- Assessing the rate of cash use as a percentage of available capital that is “fully” allocated.

❑

Different ways to view returns vis-à-vis original Cash Balance and Net Liquidating Value.

❑

Benchmarking your portfolio’s P/L against the market’s default performance, risk-free rate of return, other non-equity benchmarks and indices of professionally-run hedge funds.

WHO IS THIS COURSE FOR? Main Audience & Key Objectives

❑

Traded 1-2 years; but, unable to break even or results are random. There is a clear need to progress towards consistent and profitable results.

❑

Lost much, want to give up? Don't! Profitable trading from home is possible.

❑

Remove pattern confusion in time based charts (Candlesticks/Heikin Ashi & OHLC) with Point & Figure charts; plus, Relative Strength logic to target relevant Asset Classes.

❑

Independently validate the logic to Enter, Stay In–Play and Exit by forecasting Implied Volatility specific to the spread type's Put versus Call construction (or combined). Brain power over software crutches.

❑

Assess trading as a viable home business. Use a detailed home budget linked into the performance metrics of your portfolio.

HOW AND WHY ARE THE METHODS DIFFERENT FROM OTHER TECHNIQUES?

There are only 3 elements to hedge in an option's trade: Price, time in the form of Theta and Implied Volatility.

❑

The only way to remove Price Risk from any one specific traded product is to trade multiple asset classes, beyond stocks. And the only way to isolate Price separate from the noise of time - pure price observation - is to use Point and Figure charts.

❑

Theta and Implied Volatility are not mutually exclusive. Theta, either in the form of long decay in a debit spread; or, short premium in a credit spread is the synthetic equivalent of Implied Volatility. Conversely, IV is synthetic Theta.

Options cannot lose more than 1 day's worth of Theta as decay; or, collect more than 1 day's worth of credit sold. But IV can rise by more than one day's worth of Theta to wipe out the positive Theta collected as credit premium. Just as IV can rise by more than one day's worth of Theta decay to offset the negative Theta in a debit spread. Clearly, there is a need to forecast Implied Volatility and its associated Skew.

The methods focus specifically on Index options, diversifying the asset allocation of capital beyond Stocks, to include Currencies, Commodities, Market Cap categories, Sectors and Geographies using Indexes/ETFs.

It is the only retail trading process that uniquely blends the Relative Strength measure of Price (not the TA Indicator RSI) from Dorsey Wright, to target the relevant asset class within a multi-asset class portfolio to identify a probable trade; then, forecast Implied Volatility and Skew using tools from iVolatility to stringently test a potential trade's Theoretical Price and probability of profit versus its odds for a loss, based on IV and Theta changes, in the ThinkorSwim platform.

Preview an original video–based curriculum to see reliable "How To" methods with solid logic for "Why" each method is valid.

What this Website is Not

❑

No day trades. No stock picking. No hitting home runs. No black box algorithm or "exclusive" TA Indicator. No “secrets” only revealed in newsletters; or, gimmicks to sell you yet another piece of "magical" software or expensive training course upgrade.

You are likely to already own the technologies discussed here; or, afford the low

cost services used in the techniques taught. The process designed to trade from home incorporates use of free websites. The course is designed for you to grow out of it, to think independently about your own trading methods.

❑

Not an advisory service. No specific stock or other security buy/sell recommendations. Methods taught give you adequate logic to decide if a probable opportunity makes sense for you to independently trade it. Home Options Trading does not trade on your behalf.

Brought to you by a trader who is trading from home. No guru. No "master" of the markets. Just a retail trader connecting with and building a larger community of self-directed traders globally.

Option trading strategies designed for traders to complete the trading process within 2 hours per day, methods can be adapted to suit home traders based in both non-US and US time zones.